finance

Federal Tax ID

36-6006028

Taxes

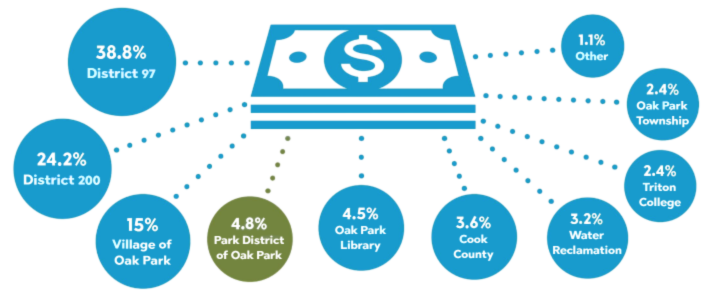

Approximately 4.8% of your property tax bill is paid to the Park District of Oak Park. The taxes collected fund less than half of our operating expenses. The Park District funds the remaining expenses through earned revenue from program fees, facility rentals, grants, and donations. Maintaining diverse revenue streams allows the Park District to continue to maintain a balanced budget while limiting the tax burden to under 5% of the total tax bill.